The Tax Cuts and Jobs Act has finally passed both the House and the Senate, and now only awaits signature by President Trump. The Democrats have been bad-mouthing the bill for some time now, and unfortunately, most in the mainstream media have been parroting their criticism. It’s as if the press just adopted the Democrats’ talking points as their own.

It’s no wonder that when polled, more people say they’re against the Republican tax plan than are for it. They’ve been misled as to what’s actually in the bill. Interestingly, when people are polled, item by item, on what’s actually in the bill, they overwhelmingly support those things.

So what’s actually in the bill? Well, as you know, both the House and the Senate passed their own versions of tax reform, and then worked out their differences in a conference committee. Here are the highlights of the final bill which just passed the House and the Senate.

First of all, the vast majority of Americans will pay less in taxes next year, than they did this year. And that’s people at low, middle, and upper income levels. The seven tax brackets are lowered pretty much across the board, with the highest bracket falling from the current 39.6% down to 37%. I would have preferred to see fewer brackets, and ideally just a one bracket flat tax, but I’m only one of 535, and that was just a bridge too far.

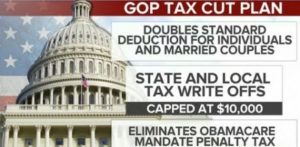

The standard deduction will nearly double, from $6,500 to $13,000 for individuals, and from $12,000 to $24,000 for married couples. As a result of this change, far more people will forgo itemizing, and will be able to file their taxes on a postcard (although admittedly a pretty large postcard) — probably 80% to 90% of tax filers.

The child tax credit will double from $1,000 to $2,000 per child. Student loan interest can still be deducted. Rather than eliminating the deduction for medical expenses, people will be able to deduct even more of them. The maximum deduction for mortgage interest on a new home will be reduced from $1 million to $750,000. And people will still be allowed to deduct their state and local taxes, whether property, sales, or income – up to a total altogether of $10,000.

Although the death tax (federal inheritance tax) will not fully go away, as I had hoped it would, fewer estates will be subject to the tax – only those worth over $11.2 million. And one of the most significant things this tax bill does, is end the mandate that requires people to pay a fine if they don’t buy the healthcare plan the federal government thinks they should have. This may not be a full repeal of Obamacare, but it’s a big step in that direction.

How does the tax bill affect American businesses? Well, the aim was to encourage businesses to invest, grow and create more jobs for more people. Here are the things it does to accomplish those goals.

Corporate tax rates, which currently are the highest in the industrialized world, will be reduced from 35% down to 21%. The tax on small businesses will be reduced from nearly 40% down to 20% for the first $315,000 of profit, and the rate increases from there, up to no more than 29.6%. Businesses can write off the full cost of new equipment purchased, in the same year it’s bought. The bill also encourages overseas American businesses to bring profits back to the United States, and thus create jobs here at home.

There are other provisions in the bill, but the ones I mentioned are, I believe, the most significant ones. The bottom line is, ignore the naysayers, especially those Democrats who are suddenly concerned about the deficit, after never giving a damn about it in the past. The “cost” of the tax cuts will be more than paid for by economic growth from the tax cuts.

And finally, I wish you and your loved ones a very Merry Christmas and a wonderful New Year!