Since the Republican tax plan was just released last week, it was my intention to review it with you this week. And that’s what I’m going to do.

However, I’d be remiss if I didn’t recognize the horrific shooting that happened in Las Vegas two days ago. I really don’t have the words to express how truly terrible this thing was. Dozens and dozens of innocent people killed, and hundreds and hundreds wounded. Predictably, some on the left (like Hillary Clinton) couldn’t resist the urge to immediately call for more gun control. Let’s let the families, and the nation, grieve and heal at least somewhat, before we go down that road yet once again. May a merciful God grant at least some comfort to the families of those impacted by this evil act.

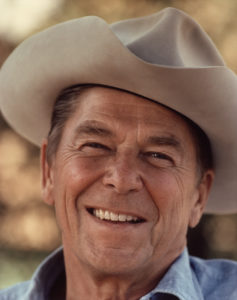

Now back to reforming our tax code, which hasn’t had a major overhaul since 1986, when Ronald Reagan was President (and I was in my first term on Cincinnati City Council.) The idea is to make our tax code simpler, fairer, and easier to understand. Let hardworking taxpayers keep more of what they earn. And make American businesses more competitive so they can grow and create more jobs for more Americans. Here’s how the Republican tax plan does those things.

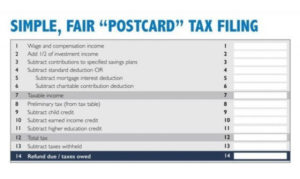

The tax code is dramatically simplified by reducing the seven current brackets down to just three – 12%, 25% and 35%. The standard deduction is doubled to $24,000 for a married couple, or $12,000 if you’re single. The vast majority of deductions are eliminated, except for home mortgage interest and charitable contributions. We also keep the child tax credit and a few other items. As a result, it’s estimated that 90% of taxpayers will be able to take the standard deduction and not itemize their taxes. Their tax return will be the size of a postcard!

I mentioned that under the plan most deductions will go away. One of those going away is deducting state taxes from one’s federal income taxes. For years now, people who live in low tax states have been subsidizing those in high income tax states (like New York and New Jersey and Illinois and California.) Ohio is neither in the top ten high tax states, nor in the ten states with the lowest state tax rates. Now it’s very possible that there could be significant changes in this and other parts of the plan before it is voted on in the House and the Senate. And as always, I welcome your input before I have to vote on the plan.

A few more important changes. The Republican plan does away altogether with the federal inheritance tax (death tax.) Currently, when a person dies, the federal government can take up to 55% of what a person has when they die. If the Republican plan passes, when a person passes away, his heirs (spouse and children usually) get what’s been acquired during that person’s life – not the government. I expect the Democrats to make a big deal about President Trump benefiting from this because he’s obviously very wealthy, and could otherwise pay a fairly hefty estate tax.

Interestingly, President Trump recently announced (rather unexpectedly) that he didn’t think people like him should benefit from the tax plan, so he doesn’t want the current top 39.6% rate reduced. So even though the plan had originally been to have a top rate of 35%, there may very well be a continuation of the 39.6% rate for top earners. We’ll see.

We’re also doing away with the alternative minimum tax (AMT.) This cumbersome provision currently requires many people to figure their taxes, then figure them a second time under the AMT, and then pay the higher of the two. Good riddance!

Finally, here’s how the new plan affects businesses. We currently have the highest corporate taxes in the industrialized world. Under the Republican plan, they’ll be cut by about 40% — from 35% down to 25%. The average on the world scene is 22.5%, so we’ll be far more competitive, and should create more jobs in America.

As for small businesses, taxes will also effectively be cut by 40% — from around 40% to 25%. Many small businesses are what are called “pass throughs” meaning the small business owner pays taxes on his or her business at his or her own personal rate. The reduced tax rate should make small businesses across America more efficient, competitive, and viable. Businesses will also be able to purchase new equipment and write it off in the same year, which should further invigorate the economy, make businesses more productive, and create more jobs.

There’s more, but that’s enough for one sitting. If you have any questions, feel free to contact my office anytime. And I thought I’d leave you with a Ronald Reagan quote. Actually two, because they were both so good, I didn’t want to choose between them. First quote: “The American people are not undertaxed, the government in Washington is overfed.” And the second one: “You can’t be for big government, big taxes, and big bureaucracy, and still be for the little guy.”

See you next week.