There are a whole bunch of Democrats who would like to be “the chosen one” to run against President Trump in the next election. Elizabeth Warren of Massachusetts, Tulsi Gabbard of Hawaii, and Julian Castro of Texas are a few who have already thrown their hats into the ring. I would expect a slew of others to jump in in the upcoming weeks and months.

The energy in the Democrat party currently is on the left. And for that reason, Democrats seem to want to outdo each other on how far to the left they can go.

This is happening on issue after issue. On health care, it used to be enough to support Obamacare. Now Democrats must support “Medicare for All” which would cost incredible amounts of money and involve a total government takeover of everyone’s health care at every level.

On immigration, only a few years ago Chuck Schumer, Nancy Pelosi, and even Barack Obama were for controlling our borders and building a physical barrier to keep what they then referred to as “illegal aliens” out. Now they’re for open borders and sanctuary cities (even sanctuary states.)

And on an issue I’d like to focus the rest of this week’s blog, taxes, the Democrats are trying to outdo each other on how much of your hard-earned money they can take. Before I get into the specifics, a little history. Democratic President Franklin Delano Roosevelt, in order to pay for his New Deal programs and WWII, pushed income tax rates up to 94% in the 1940’s. John F. Kennedy brought the top federal tax rate down to 70% in the 1960’s. President Reagan (God bless him) fought to bring the top tax rate down to 28% in the 1980’s. As a result of George H. W. Bush breaking his “read my lips, no new taxes” pledge, taxes went up from 28% to 31%. Clinton pushed them up to 40%, before George W. brought them back down to 35%. Obama pushed them back up to 40% again, and as a result of the signing of the Republican Tax Cuts and Jobs Act, President Trump dropped the top marginal rates down to 37%. Got it?

Okay, so now Democrats want to raise your taxes again. Let’s start with someone we all know and love – Bernie Sanders. (Well, at least we all know him.) Bernie has been saying for years now that we should raise the top tax rate to 50%. So, under his plan, the federal government would take half of what you earn. That’s a lot, but Bernie’s a piker compared with some other Democrats.

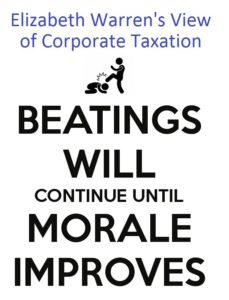

Elizabeth Warren won’t give us a specific number yet. But she said recently that there was a time in America when top tax rates were “well above 50%.” And she expressed no reservations whatsoever about going back to those high levels again.

Alexandria Ocasio-Cortez, who is the New York Democrat recently elected to Congress whom the press can’t seem to get enough of, or write enough about, calls herself a “socialist.” And she said on “60 Minutes” last week that tax rates at 70% are fine with her.

And Julian Castro, who jumped into the Democratic presidential race last Saturday, could hardly hide his glee in reminding people that “there was a time in this country when the top marginal tax rate was over 90%.” It’s probably only a matter of time before we have a Democrat candidate pondering why the government can’t just take 100%. After all, it would relieve us of the stress of having to decide how to spend our money. We wouldn’t have any. The government would have taken it all.

The bottom line is, there is a key difference in how Democrats and Republicans look at taxes. More and more Democrats are coming to the conclusion that the government should take as much of your money as possible, and spend it the way they think is best. Republicans think that you should keep as much of your hard-earned money as possible, and spend it the way you wish. The public will decide which way we go in less than twenty-four months.