The U.S. House of Representatives passed its version of reforming the tax code almost three weeks ago. Then the Senate followed up and passed a similar, although not identical, tax bill a few days ago. So where do we go from here?

Well, now a relatively small number of Members from both the House and the Senate will begin meeting as something called a Conference Committee, and they’ll try to iron out the differences between the bill that was passed in the House, and the one that was passed in the Senate. Every issue must be agreed upon, because an identical bill, with exactly the same language, must go back to both the House and the Senate and be re-voted upon. If that identical bill passes both houses, it will then be sent to President Trump for his signature. He could of course veto the bill, if it’s not to his liking. But there’s no indication that that will happen.

So what are the principal differences that have to be ironed out between the House and Senate bills? I’m glad you asked that question. There are a number of rather significant differences that have to be addressed. Here are the ones that, in my opinion, matter the most.

First, the tax cuts passed by the House, are permanent cuts, for both individuals and for businesses. The Senate’s cuts are permanent for businesses, but not for individuals. Taxes on individuals under the Senate plan automatically go back up in 2025 (unless of course some future Congress voted to cut them again.) I hope the House prevails on this, because I’d like to keep taxes lower on everybody – permanently.

Second, under the House bill, corporate tax rates (which are currently the highest in the industrialized world), will be reduced from 35% down to 20%, on January 1 (less than a month from now.) Under the Senate plan however, these corporate tax cuts won’t kick in for another year – January 1, 2019. Here’s the problem with the Senate version. The boost to the economy will be delayed for a whole year – and not insignificantly, until after the election next year. Senate Republicans are guilty of political malpractice on this, and the House position should, and I believe will, prevail.

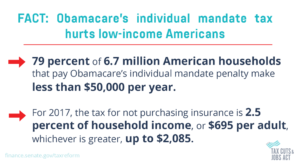

Third – and here’s one I prefer the Senate position. The Republican Senate tax bill repeals the Obamacare mandate that requires everyone to purchase the healthcare plan the government wants or pay a fine. President Trump brought this up after the House had already passed its plan, so it’s not in the House bill. I prefer the Senate bill – let’s get rid of the Obamacare mandate once and for all. Hurrah!

Fourth, when a person dies, the government currently can take up to 55% of that person’s estate (depending on the size of the estate.) And that person has already paid taxes on those assets throughout his or her life. The House bill doubles the threshold at which a person’s estate must be before he or she owes any taxes, and then eliminates estate taxes (death taxes) altogether in 2025. The Senate bill doubles the threshold as the House did, but never eliminates the death tax. The House bill is far preferable.

Okay, two more provisions. The House bill repeals the Alternative Minimum Tax (AMT) altogether – the Senate bill lowers the tax a bit, but keeps it. (The House is better.) And both the House and the Senate plans allow homeowners to fully deduct mortgage interest on their current homes. But on new home purchases, the House limits the deduction to $500,000, and the Senate keeps the current $1 million deduction. (The Senate is better.)

In my opinion, these are the main differences you may want to know about. As I said previously, they’ll hopefully be worked out in the Conference Committee. The important thing is, we’re on the verge of dramatically simplifying the tax code, and lowering taxes on the vast majority of taxpayers. This will be very positive for the economy and for most Americans. Despite that fact, Congressional Democrats, and their friends in the mainstream media, will continue to do everything within their power to convince you that it’s just tax cuts for the rich, and hurts everyone else. Don’t believe it.